The "Meta-Universe + Foreign Trade" reflects reality

March17,2023

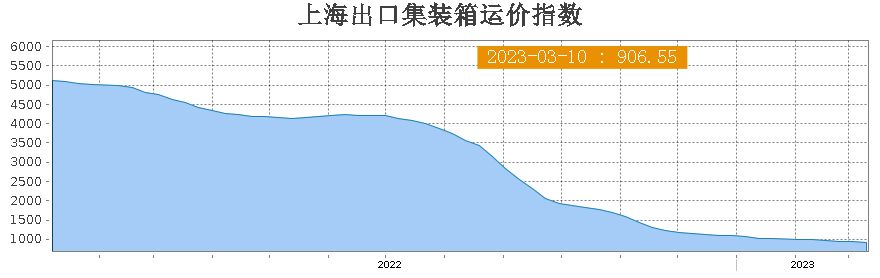

Container ship freight rates are still in a downward path. The Shanghai Export Container Freight Index (SCFI) fell again last week, and whether it can hold 900 points this week has become the focus of market attention.

Freight rates have fallen for nine consecutive years

The decline in the container ship market continues to expand

According to the latest data released by the Shanghai Airlines Exchange on March 10th, the Shanghai Export Container Freight Index (SCFI) fell 24.53 points to 906.55 points last week, a 2.63% weekly decline.

SCFI show nine consecutive declines, but it was below the 1000 point mark for five consecutive weeks, with a significant increase in the decline compared to 1.65% in the previous week.

Shanghai Export Container Freight Index

Last week, the freight rate per FEU for the Far East area to the United States West Line fell by $37 to $1163, a decrease of 3.08%, an increase from the previous week's decrease of 2.76%.

Currently, the industry worry about the US East route is beginning to make up for losses. The freight rate per FEU for the Far East to the United States East Line fell by $127 to $2194 per week, expanding from 2.93% in the previous week to 5.47%.

Industry insiders said that the freight rates between the United States and the West have basically bottomed out, and there is still space for the freight rates between the United States and the East to decrease compared to before the epidemic.

In addition, the freight rate per TEU for the Far East to Mediterranean Line fell by $11 to $1589, a decrease of 0.69%, slightly expanding from a decrease of 0.31% in the previous week.

However, the freight rate for the Far East to Europe line was $865 per TEU, which was the same as the previous week.

South America Line (Santos):The lack of momentum for further growth in transportation demand has led to a weakening of supply and demand fundamentals, and freight prices have been in a downward trend recently. The freight rate from Shanghai to the South American base port was $1378/TEU, down $104 or 7.02% for the week;

Persian Gulf Route:The recent performance of the transportation market has been relatively sluggish, with weak growth in transportation demand, poor supply and demand relations, and a sustained decline in market freight prices. The market freight rate from Shanghai to the Persian Gulf base port was US $878/TEU, down 9.0% from the previous period.

Australia New Zealand Route:The demand for various materials in the local market has been hovering at a low level since the long holiday, with transportation demand recovering slowly, supply and demand fundamentals weak, and market freight prices continuing to adjust. The freight rate from Shanghai to the basic port of Australia and New Zealand was US $280/TEU, down 16.2% from the previous period.

In terms of offshore routes, the Far East to Kansai and Kandong in Japan were both flat with the previous week; The freight rate from the Far East to Southeast Asia (Singapore) was $177 per box, an increase of $3 or 1.69% compared to the previous week; As for the Far East to South Korea, it fell by $2 compared to the previous week.

Industry insiders pointed out that container shipping companies have actively adjusted their transportation capacity, coupled with a slight increase in the momentum of shipments from Asian factories after the year, and that many container ships on the European line have been full by the end of March,it is good for stabilize freight rates;

However, due to high inflation pressure in the United States, retailers and importers are conservative in purchasing goods, and the relatively high freight rates on the eastern route of the United States have attracted ships from all over the world, resulting in a supplementary decline in freight rates on the eastern route of the United States, which widened last week.

While spot freight rates have plummeted, the new year's long-term freight rates for the US Line are also said to have been reduced to one-third of last year's rates. However, some freight companies have changed their annual freight rates to quarterly or semi-annual freight rates to reduce the impact of freight rates. In addition, recently, the freight collection companies have been frantically reducing shifts to lengthen the transportation distance, and the attitude of freight owners has softened, which also helps to alleviate the pressure on freight prices.

Experts said that in this year, freight rates are expected to fluctuate at a low level. Currently, freight rates have fallen to around the cost price of the shipping company, and there should be limited room for further decline. However, the time point of the bottom is indeed longer than expected.

Experts have also reminded that the demand side is still a risk to the consolidation market. Even if old ships are phased out at an accelerated pace, the supply is no longer in operation due to the port closures and a large number of new ships are being delivered, casing in a surge in global transport capacity of over 20%.

According to Alphaliner's data, as of February 1, the total number of orders held by container ships worldwide was 7.69 million TEU, slightly less than 30% of the capacity of the active fleet; 2.48 million TEU (32%) will be delivered this year, 2.95 million TEU (38%) will be delivered in 2024, and 2.26 million TEU (30%) will be delivered later.

Does the shipping company raise prices in April?

Market news also shows that in the past week, due to cabin reduction factors, some markets on the European line have experienced cabin explosion. Shipping companies are expected to start raising freight rates in April. The industry estimates that the maximum increase is $200 per large container, but it remains to be seen whether the success will be achieved.

Also, there are also large freight forwarding companies that point out some markets in the Gulf of Mexico region of the United States, including Houston, Mobil, Kansas, and others, have cabin explosions. The shipping company has a price increase plan for April, but whether it can succeed depends on the subsequent ship company's shift reduction status and cargo load growth.

In addition, there has also been a phenomenon of cabin explosion on the Southeast Asian line. Due to shipping schedule adjustments and other reasons, some domestic ports arrived in Indonesia and Thailand, Vietnam, and the cabin explosion was serious from the end of February to March, with prices continuing to rise slightly. According to this analysis, shipping experts say that the surge in cargo volume on some routes may be related to festival factors such as Ramadan, and whether it can be sustained in the later stage still needs to be kept in mind.

END

Post time: Mar-17-2023